Quick poll: Which app hijacks your thumbs before breakfast – WhatsApp, TikTok or something totally new? Keep the answer handy; we’ll revisit it at the end!

2025 in a Snapshot

- 🌍 5.2 billion people – 64 % of Earth’s population use social media.

- The average user juggles 6.7 platforms per month.

- Short-form vertical video rules attention spans, but private messaging apps still host the biggest raw audiences.

Top 10 Platforms by Monthly Active Users (MAU)

| Rank | Platform | MAU (billions) | Owner | Core Format |

| 1 | 3.07 DemandSage | Meta | Feed + Groups + Reels | |

| 2 | 3.10 Resourcera | Meta | Messaging & Calls | |

| 3 | YouTube | 2.53 The Global Statistics | Long & Short Video | |

| 4 | 2.00 DemandSage | Meta | Visual Feed + Reels | |

| 5 | 1.38 The Global Statistics | Tencent | Super-App | |

| 6 | TikTok | 1.59 The Global Statistics | ByteDance | Short Video |

| 7 | Snapchat | 0.85 SimpleBeen | Snap Inc. | AR Lenses & Chat |

| 8 | X (Twitter) | 0.61 DemandSage | xAI | Micro-Posts |

| 9 | 0.57 Resourcera | Pinterest Inc. | Visual Discovery | |

| 10 | 0.31 Sci-Tech Today | Microsoft | Professional Graph |

Deep-Dive: What Makes Each Platform Tick

Quick-Scan Platform Cheat Sheet (2025)

| Platform | Leading markets* | Platform type | Top demographic* | Best for | Used by |

| India 375 M, US 194 M | Social networking / feeds & groups | 25–34 yrs lead (≈31 %) | Broad reach, communities, Marketplace | 3.07 B MAU | |

| India 536 M, Brazil 124 M, US 100 M | Mobile messaging / calls | 18–34 yrs most active (31 %) | 1-to-1 support, conversational commerce | 3.10 B MAU | |

| YouTube | India 491 M, US 253 M, Brazil 144 M | Video-sharing (long & Shorts) | 25–34 yrs (21 %) | Attention economy, education | 2.53 B MAU |

| India 414 M, US 172 M, Brazil 141 M | Visual social / Reels & Stories | 18–34 yrs (64.6 %) | Lifestyle branding, influencer collabs | 2.00 B MAU | |

| China 810 M, Malaysia 12 M, India 10 M | Super-app (chat, pay, mini-programs) | 18–29 yrs core (35 %) | China market entry, mini-stores | 1.38 B MAU | |

| TikTok | US 135 M, Brazil 84 M (+ fastest growth in ID) | Short-form video / live shopping | 18–24 yrs (39 %) | Viral reach, Gen Z culture | 1.59 B MAU |

| Snapchat | India 208 M, US 106 M, Pakistan 38 M | Multimedia messaging & AR lenses | 18–24 yrs (35 %) | AR try-ons, youth buzz | 0.85 B MAU |

| X (Twitter) | US 106 M, Japan 71 M, Indonesia 25 M | Micro-blog / real-time news | 25–34 yrs (36.6 %) | News-jacking, thought-leadership | 0.61 B MAU |

| US 84.6 M, Brazil 28 M, Mexico 20 M | Visual discovery / idea boards | 18–24 yrs (27.2 %) | High-intent shopping, trend-spotting | 0.57 B MAU | |

| US 236 M, India 140 M, Brazil 81 M | Professional networking / careers | 25–34 yrs (47.3 %) | B2B leads, hiring, thought-leadership | 0.31 B MAU |

*“Leading markets” = largest national audiences; “Top demographic” = largest global age band on the platform.

1. Facebook – The Giant That Won’t Quit

The blue-and-white giant remains the globe’s largest digital town square, where Marketplace bargains, lively groups and short Reels keep billions of thumbs busy every single day. With 3.07 B MAU, Facebook still offers unmatched breadth. Reels now display automatically in feed, and Marketplace drives 29 % of mobile sessions.

💡 Marketing tip: Cross-post 30-second Reels of Marketplace listings; sellers using the Reels-Marketplace combo average a 24 % lift in ROAS.

2. WhatsApp – Messaging Meets Commerce

What began as a simple chat app has evolved into a private shopping lane where catalogues, payments and support live inside the same friendly thread. Click-to-WhatsApp ads open in-thread catalogs and payments, helping the app top 3.1 B MAU.

💡 Marketing tip: Reply within the free 24-hour “entry window” after a click ad fires – keeping the chat fee-free for 72 h often trims CPA by ~30 %.

3. YouTube – The Attention King

The long-form storyteller and short-form discovery engine sit side-by-side here, letting experts teach deeply while snackable Shorts pull new viewers in with irresistible teasers. Shorts hit 70 B daily views, yet long-form still monetises best via memberships and pre-rolls.

💡 Marketing tip: Publish a Shorts teaser within 24 h of any long-form upload; Google reports that early-trend Shorts double subscriber growth.

4. Instagram – Visual Culture Evolves

Picture-first culture still thrives, but looping Reels, ephemeral Stories and direct-to-inbox Broadcast Channels now move trends faster than any filter ever could. Reels earn double the engagement of photos, and Broadcast Channels drop updates into followers’ DMs.

💡 Marketing tip: Launch a Broadcast Channel for product drops, brands see ≈10× more reactions than from feed posts alone.

5. WeChat – China’s Super-App

Inside one super-app, Chinese users can chat with friends, hail a ride, pay utilities or shop a mini-store without switching screens or remembering passwords. Mini-Programs serve 945 M users and handle everything from shopping to tax filing.

💡 Marketing tip: Spin up a Mini-Program store; one-click WeChat Pay checkout lifts CVR by 20–40 %.

6. TikTok – Culture’s Hot Lab

This cultural pressure cooker sparks challenges, remixes songs and introduces micro-communities through its new Topic Feeds faster than any platform in recent memory. At 1.59 B MAU, TikTok’s Topic Feeds surface micro-communities in one tap.

💡 Marketing tip: Blend Topic-Feed targeting with micro-creators, TikTok campaigns using this mix cut CPA 33 % on average.

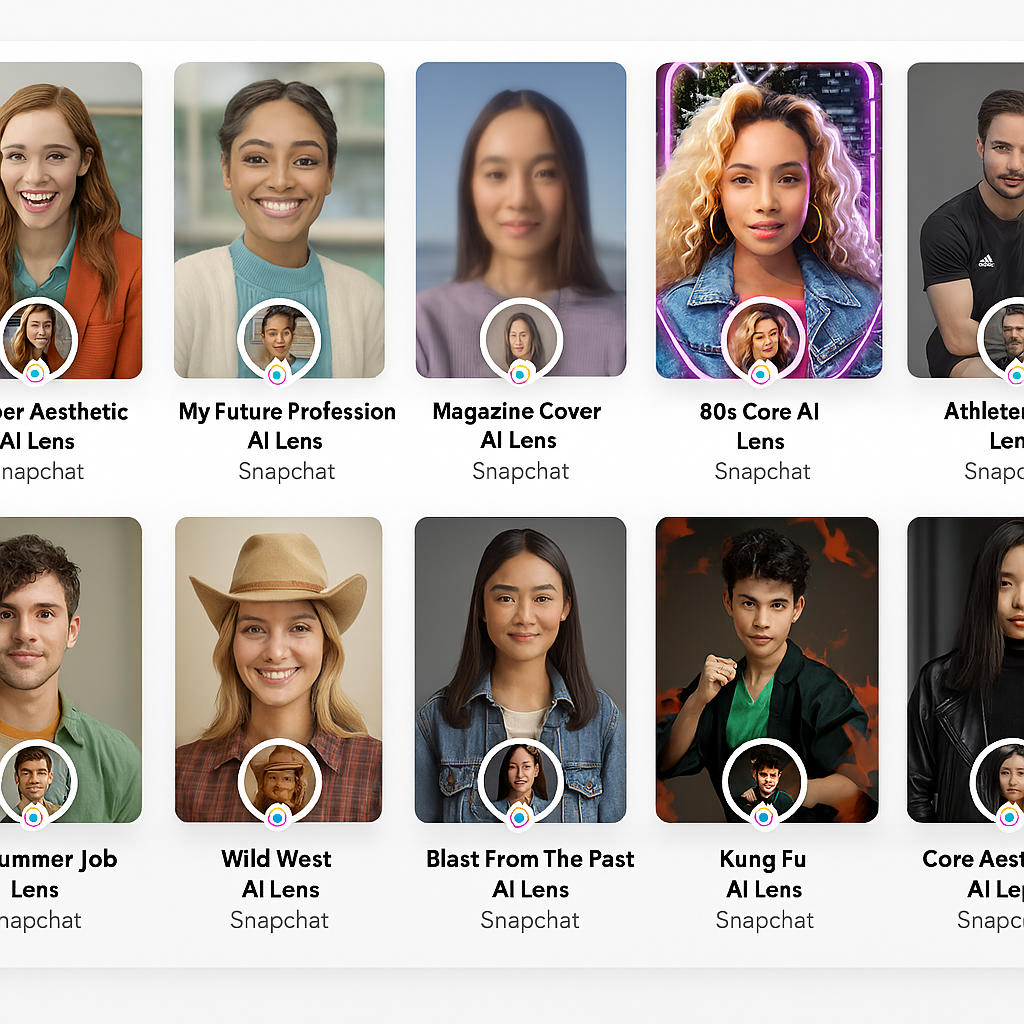

7. Snapchat – AR Pioneer

Augmented reality sits at the heart of the ghost app, where playful lenses turn ordinary faces into dream jobs, cowboy stars or eighties icons in the blink of an eye. Lens Studio 5 lets brands publish generative-AI try-on lenses in minutes.

💡 Marketing tip: Shoppable AR lenses deliver 6.4× higher swipe-to-shop rates than standard video ads.

8. X (Twitter) – From Micro-Blog to “Everything App”

The real-time pulse of breaking news now offers marathon-length Articles and live Spaces, shaping deeper conversations without ever losing its rapid heartbeat. Long-form Articles (25 k chars) plus weekly Spaces keep 611 M users engaged.

💡 Marketing tip: Pin a flagship Article and host a Q&A Space around it, pairing evergreen content with live audio grows followers 1.5× faster than tweets alone.

9. Pinterest – The Intent Engine

Users arrive here with a plan in mind – designing a nursery, perfecting a wedding palette, or dreaming up the season’s wardrobe- so every pin meets intent halfway. AI “Auto-Collages” remix catalogs into thousands of shoppable boards.

💡 Marketing tip: Opt into Pinterest Ad Labs, early testers doubled save-rates and shaved 15 % off CPA.

10. LinkedIn – Niche but Necessary

The professional graph may be smaller than the mainstream networks, yet its feed buzzes with decision-makers browsing between meetings and budget reviews. Ad reach tops 1.2 B members; Live Events and Audio Rooms fuel engagement.

💡 Marketing tip: Stream a monthly LinkedIn Live; live videos get 7× reactions and 24× comments over uploads.

Engagement Trends You Can’t Ignore

- Short-video supremacy: YouTube Shorts account for 70 B daily views.

- Messaging beats feeds: Private shares (DMs, Stories, Groups) now exceed timeline interactions on Meta apps.

- Social commerce boom: Pinterest’s Auto-Collages and Instagram’s checkout shrink the funnel.

- Audio settles in: Twitter Spaces nurtures real-time conversation even as pure audio apps fade.

Reflection challenge: Check your analytics, what share of clicks comes from private shares versus public feeds? Shift CTAs accordingly.

Picking the Right Channel for Your Goals

| Goal | Best-fit platforms | Why |

| Mass awareness | Facebook, YouTube | Biggest reach + low CPM |

| Gen Z buzz | TikTok, Snapchat | Trend velocity & AR filters |

| High-intent shopping | Pinterest, Instagram | Visual search + in-app checkout |

| Customer support | WhatsApp, X | Real-time conversational threads |

| B2B thought-leadership | LinkedIn, YouTube | Professional context & depth |

Start with one or two primaries, then repurpose assets (podcast → Shorts → LinkedIn carousel) to stay sane.

Key Takeaways

- Meta still dominates three of the top four slots.

- Video-first approaches are now table stakes.

- Private conversation equals deeper trust.

- Smaller networks convert: LinkedIn’s modest MAU often yields premium leads.

- Data ≠ destiny: Match platform culture to your voice, then test, learn, repeat.

Your turn 🎉

Revisit the opening poll, has the data changed your favorite app? Tell us below (or share this guide) and tag the network you least expected to use next!